BookingSync allows you to manage the taxes that apply to the rent or to the services you offer.

In this article

- How to apply a new tax in your bookings

- How to apply a new tax to your fees and services

- How to apply a city tax with a maximum amount per night and per adult (France)

How to apply a new tax to your bookings

There are 3 steps to apply a tax to your bookings:

- Create the tax in the Settings > Taxes section

- Add the tax previously created in the Rental > Taxes tab

- Choose the corresponding invoice date in the booking (creation date by default)

The tax will be applied to the initial price according to the invoice date and will show in the tax section of the booking.

How to apply a new tax to your fees and services

There are 3 steps to apply a tax in your fees and services:

- Create the tax in the Settings > Taxes section

- Add the tax previously created to the fee in the Settings > Fees/Services section

- Choose the corresponding invoice date in the booking (creation date by default)

The tax will be applied to the fee or service price according to the invoice date and will show in the tax section of the booking.

How to apply a city tax with a maximum amount per night and per adult (French city tax)

In order to apply a city tax with a maximum per night and per adult (as per French regulation), you will need to create this tax as a fee.

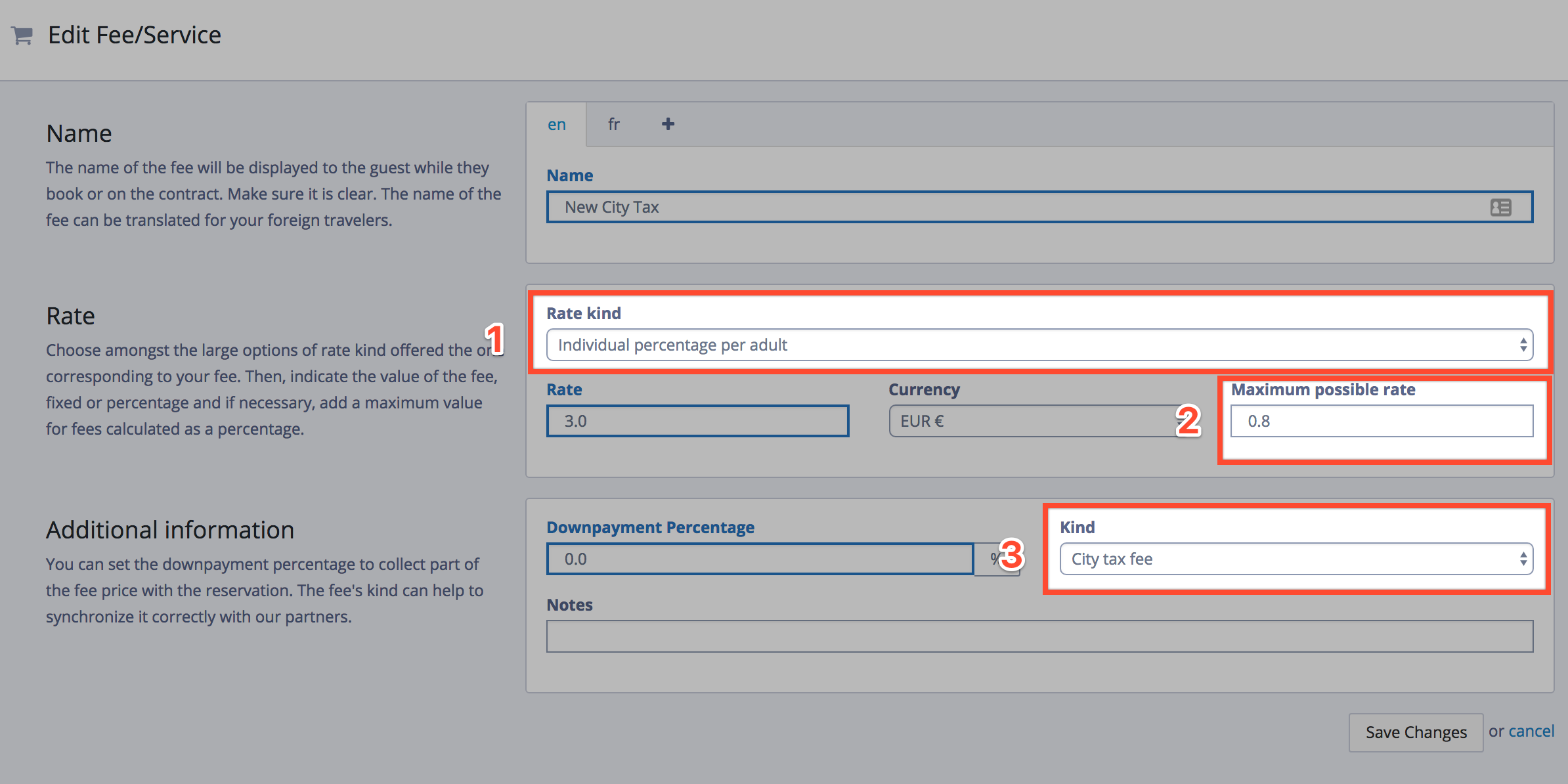

Step 1 - Create the fee in the Settings > Fees section

To make sure the city tax is applied with a maximum amount per night and per adult, there are 3 important settings:

(1) Rate kind: Individual percentage per adult needs to be selected as the rate kind.

(2) Maximum possible rate: the fixed maximum amount per adult and per night.

(3) Kind: city tax fee needs to be selected.

In this example, the city tax fee is set to 3% of the rental price per night and per adult, with a maximum of 0.80EUR per night and per adult.

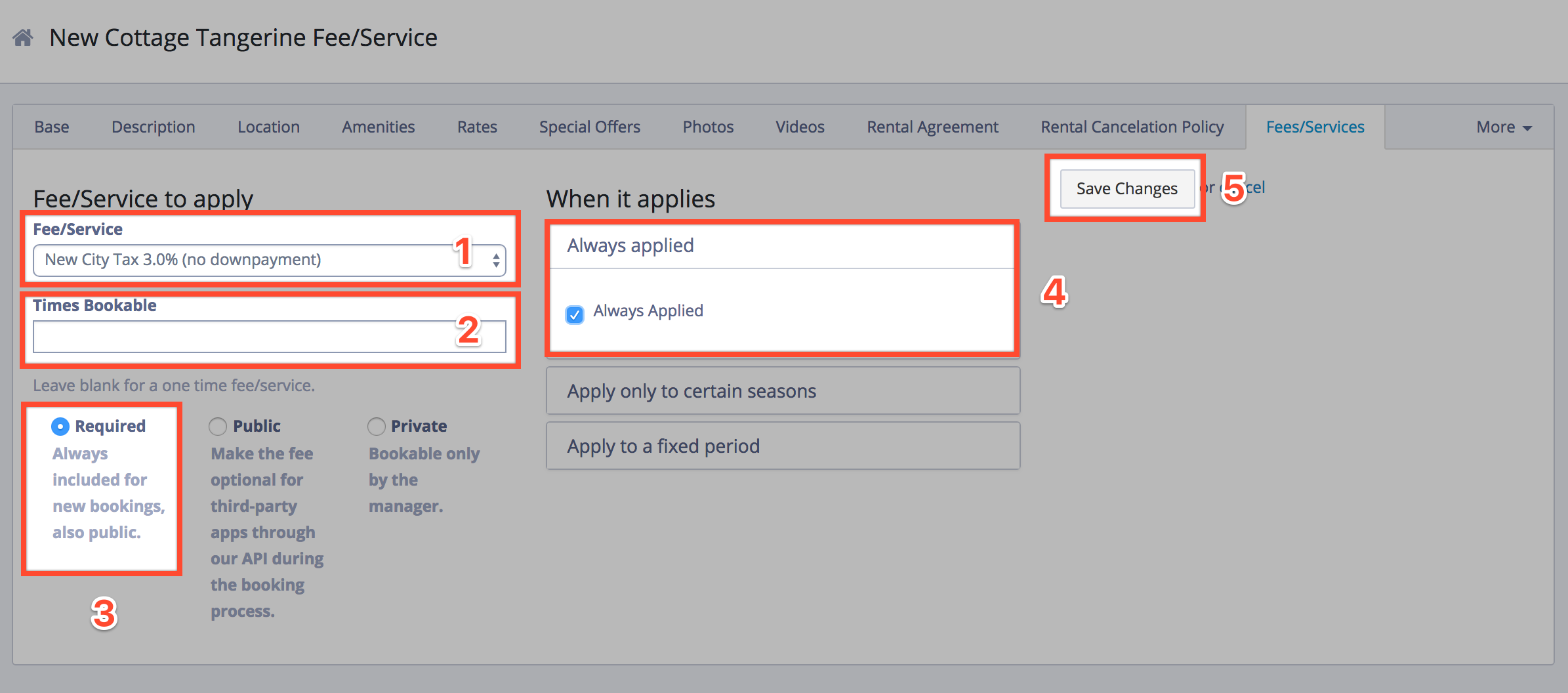

Step 2 - Add the fee previously created in the Rentals > Fees/Services tab

(1) Select the name of the fee in the Fee/Service drop down menu.

(2) Times bookable: you can keep this field empty.

(3) Select Required - Always included for new bookings, also public to apply this fee to all new bookings.

(4) When it applies: you can select Always applied.

(5) Finally, click Save changes to save your new city tax.

Here is an example on the city tax will be calculated on your booking :

200 (initial_price) / 2 (guests) = 100 (price per guest)

100 / 2 (number of nights) = 50 (price per guest per night)

50 * 0.03 (3% tax) = 1.5 (fee rate per guest per night)

[1.5, 0.8(max rate)].min = 0.8 fee rate per guest per night) > The ceiling price is used in that case

0.8 * 2 (nights) * 2 (guests) = 3.20€

Comments

0 comments

Please sign in to leave a comment.